DESIGNED FOR YOU

Not approved for a mortgage? Self Employed? Bad credit? No problem. Buy a house with our program regardless of your credit score. You can get home ownership now and quit wasting money on rent. It’s that simple!

FAQ's

What are the qualifications?

- Can start with as little as 5% to put down on the property based on purchase price

- 1% down for program entry and loan origination fee of the purchase price

- No evictions in the last 3 years

- Credit score above 500

- Currently paying bills on time (last 3 months)

- Income has to be at least 3.5% times the monthly payment

What if I have a lot of student loan or medical bills?

We feel you shouldn’t be penalized for getting educated or getting sick. We are able to overlook student loan and medical bill debt.

What if I can’t come up with the full 10% down payment?

Don’t worry! We don’t expect you to have the full 10% down payment by the time you move in. You only need 5% by time you sign your contract. That’s why we have created our down payment assistance program giving you up to 60 months to get to that 10%, Interest-Free!

When can I buy my home from Home Ways?

You will receive the “Contract for Deed” once you get to the 10% down position and completed 3 year lease-purchase contract. Then you may finance through a traditional bank or go through our in-house financing.

HOMEWAYS IS A GREAT FIT FOR YOU IF...

You need some time to get your finances in order

HomeWays only looks at your last 3 months of income, which means if you’re self employed, started a new job, we are a great option. Traditional lenders typically require 12 months or more to fully document your income.

Your credit score isn’t quite where it needs to be...yet

We accept a minimum 500 credit score, which means that even if you’ve hit a few problems along the way, we are an awesome option.

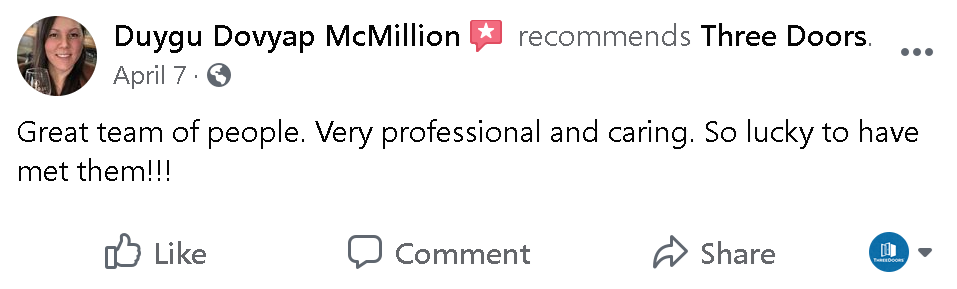

WHAT DO PEOPLE SAY ABOUT HOMEWAYS?